are there any special fees for ev licensing?

As electric vehicles (EVs) become increasingly popular, understanding the nuances of EV licensing is crucial for new owners.

This article outlines what EV licensing includes, detailing various fees such as registration, licensing, and taxes. It also highlights additional expenses you should consider, such as maintenance and charging station installation.

Discover potential incentives and financing options that can help you save money on your journey.

Get ready to dive into the exciting world of EV licensing and save money!

Contents

- Key Takeaways:

- Understanding EV Licensing

- Types of Fees for EV Licensing

- Additional Costs to Consider

- Ways to Save on EV Licensing

- Key Takeaways

- Frequently Asked Questions

- Are there any special fees for EV licensing?

- What are registration fees for EV licensing?

- Do I need to pay vehicle inspection fees for EV licensing?

- Are there any special taxes for EV licensing?

- Do I have to pay for special EV license plates?

- Are there any other fees I should be aware of for EV licensing?

Key Takeaways:

EV licensing includes registration, fees, and taxes. Additional costs like maintenance, insurance, and charging station installation should also be considered. Incentives, tax credits, and alternative financing options can help save on EV licensing expenses.

Understanding EV Licensing

Understanding EV licensing is essential for new EV owners. This includes the intricacies of electric vehicle registration, which has become increasingly important due to the rise in electric vehicle sales and changing state regulations.

States like Illinois are actively shaping policies that influence EV registration processes and associated fees. This ensures that the expansion of environmentally friendly vehicles is supported by improved transportation infrastructure and accessible public charging services.

What is EV Licensing?

EV licensing involves the steps to secure necessary documentation and permits for your electric vehicle, ensuring compliance with local and state regulations.

Start by gathering essential documents like proof of ownership, your vehicle identification number (VIN), and any applicable documents showing your vehicle’s environmental impact.

In some areas, you may also need to provide proof of residency and specific insurance for your EV. Registration fees can differ from those for conventional vehicles, often offering tax incentives or rebates designed to encourage green transportation.

Understanding that regulations may vary significantly from those governing traditional internal combustion engine vehicles is essential for navigating the licensing landscape confidently.

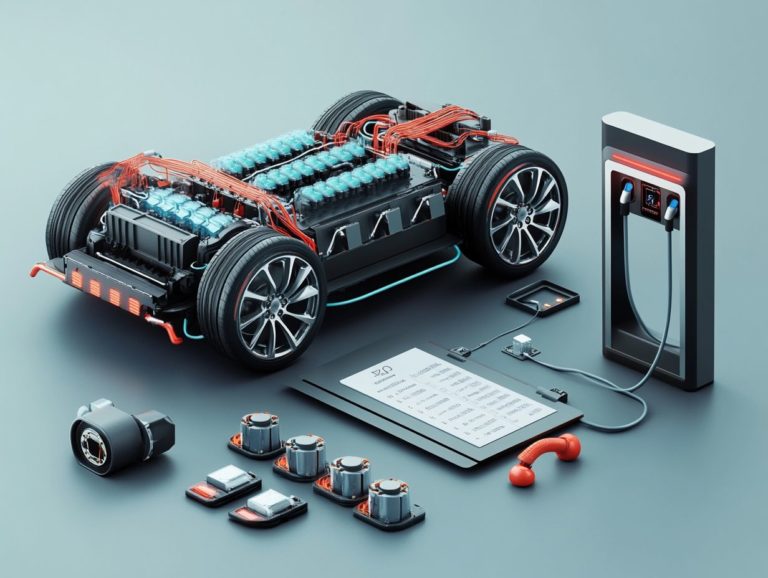

Types of Fees for EV Licensing

Navigating EV licensing involves several types of fees that electric vehicle owners must consider.

These include registration fees, licensing fees, and various potential additional charges that can differ by state, influencing your overall cost of ownership.

Registration Fees

Registration fees for electric vehicles can vary significantly by state. Some states impose higher fees for EV registration compared to traditional vehicles.

This difference often arises from regional policies aimed at either encouraging or discouraging electric vehicle adoption. For instance, some states may implement lower fees to promote greener technologies, while others might impose higher costs to compensate for lost fuel tax revenue as more drivers switch to electric.

A widespread shift to EVs significantly impacts economic strategies, affecting how states balance their environmental goals with financial realities.

Consequently, you might encounter a wide range of registration costs, reflecting the diverse strategies states employ in their journey toward more sustainable transportation options.

Licensing Fees

Licensing fees are a crucial aspect of the total cost of owning an electric vehicle. These can vary significantly by state, often influenced by policy changes from local legislatures.

These fees may encompass registration costs, renewal fees, and additional surcharges extra fees that help cover costs due to less fuel tax being collected from EVs. This is specifically levied on electric vehicles to offset the lost revenue that states typically collect from gasoline-powered cars.

For example, while you might pay between $50 to $150 annually for traditional vehicle registration, the fees for electric vehicles can be considerably higher. These differences reflect state efforts to promote or discourage the adoption of cleaner technologies.

As a prospective buyer, you’ll need to navigate these state-specific regulations. Understand how varying fees impact your overall budget and environmental objectives. It s essential to factor in these considerations as you embark on your purchasing journey.

Taxes and Other Charges

As an electric vehicle owner, you will face various taxes and additional charges that impact the overall cost of your EV experience, including sales tax and specialized electric vehicle taxes introduced by state legislatures.

These taxes are not merely a financial obligation; they play a vital role in funding essential transportation infrastructure projects in both urban and rural areas.

For instance, specific levies on electric vehicle registrations often directly contribute to road maintenance and development initiatives. This ensures that fiscal policies evolve in line with this burgeoning segment of the automotive market.

Dive into the taxation landscape to uncover savings! By examining this landscape, you can gain valuable insight into how these revenues facilitate sustained investments. These investments enhance safer and more efficient transportation systems, ultimately benefiting all road users.

Additional Costs to Consider

Beyond licensing and registration fees, you should also consider several other costs associated with electric vehicle ownership. These include maintenance, insurance, and potential expenses related to installing charging stations at home or utilizing public charging options.

Maintenance and Insurance

Maintenance and insurance for electric vehicles can vary quite a bit from what you might be used to with standard vehicles. Many EV owners have reported enjoying lower maintenance costs due to fewer moving parts in electric vehicle technology.

This doesn’t mean that all expenses related to owning an EV are automatically lower. While routine maintenance may be less demanding, specialized repairs and the necessity for software updates can accumulate over time.

Regarding insurance, rates for electric vehicles can fluctuate widely based on factors such as the model, battery size, and safety features. This creates a somewhat mixed financial landscape for prospective EV owners.

These maintenance and insurance considerations can significantly impact the overall cost of ownership, influencing your decisions and shaping the future of the market.

Charging Station Installation

The installation of charging stations, whether at home or in public areas, is essential for you as a new electric vehicle owner. It directly impacts your convenience and accessibility.

Understanding the associated costs is crucial. Home charging solutions typically involve an upfront investment in a faster home charger, which allows for quicker charging than standard outlets, and possibly some electrical upgrades. These can vary significantly based on your existing infrastructure.

Public charging stations often come with ongoing fees, such as subscription fees or per-use costs, creating a different financial scenario for regular users.

You ll need to consider factors such as charging speed, the availability of charging services in your area, and how well the infrastructure aligns with your vehicle. These elements are pivotal in shaping the most effective charging strategy for your lifestyle.

Ways to Save on EV Licensing

As an electric vehicle owner, you have access to a range of opportunities to save on licensing costs. Numerous incentives and tax credits provided by state legislatures are designed to encourage the adoption of electric vehicles.

By taking advantage of these programs, you can significantly reduce your expenses while embracing a more sustainable mode of transportation. Act now to explore your options and start saving today!

Key Takeaways

1. Licensing and registration fees for electric vehicles can be higher than traditional vehicles.

2. Taxes and additional charges play a significant role in funding transportation infrastructure.

3. Maintenance and insurance can be lower, but specialized repairs may add costs.

4. Consider the costs of charging station installation for convenience.

5. Explore available incentives to save on licensing costs.

Incentives and Tax Credits

Incentives and tax credits for electric vehicle owners differ significantly from state to state. Some provide substantial savings through tax benefits and rebates designed to promote EV adoption.

These financial incentives encompass a range of options. Federal tax credits aim to decrease the initial purchase price, while state-level rebates can considerably reduce your upfront costs.

You might be excited to find additional perks in certain states, such as access to carpool lanes and lower registration fees. These advantages further enhance the appeal of electric vehicles.

These programs reward buyers based on the type of vehicle acquired and the amount of energy the battery can hold. Grasping the complexities of state regulations is essential, as the tax treatment can profoundly affect the overall cost of ownership, making electric vehicles a more financially appealing choice for you.

Alternative Financing Options

Exploring alternative financing options for electric vehicle purchases can significantly alleviate the financial strain you may face as a new EV owner. These options offer accessible pathways to ownership.

Among these options, traditional loans allow you to spread payments over time, making high-end electric models more within reach. Leasing is another enticing alternative, often requiring a lower upfront cost while letting you drive a new vehicle every few years.

Don’t overlook government incentives and rebates; they can substantially offset initial expenses and help enhance affordability.

Consider specialized credit unions, which frequently offer reduced interest rates specifically designed for eco-friendly purchases. Use these funding options to save big and step confidently into the future!

Frequently Asked Questions

Are there any special fees for EV licensing?

Yes, there may be some special fees associated with EV licensing depending on your state and local regulations. These fees may include:

- Registration fees

- Vehicle inspection fees

- Special EV-specific taxes

What are registration fees for EV licensing?

Registration fees for EV licensing are similar to those for traditional vehicles but may vary by state. These fees cover administrative costs and typically range from $50 to $200.

Do I need to pay vehicle inspection fees for EV licensing?

In some states, EVs are subject to special emissions and safety inspections, similar to traditional vehicles. This may incur an additional fee, usually around $25-$50.

Are there any special taxes for EV licensing?

Some states have implemented special taxes for EVs to compensate for the lack of gas tax revenue. These taxes may be based on the vehicle’s weight, battery size, or other factors, ranging from $50 to $200 annually.

Do I have to pay for special EV license plates?

Some states may require EV owners to have special license plates to indicate that the vehicle is electric. These plates may come at an additional cost of around $25-$50.

Are there any other fees I should be aware of for EV licensing?

In addition to the fees mentioned above, some states may also charge a special EV surcharge on top of regular vehicle registration fees. This surcharge may vary but is typically around $100 annually.

Check your local state incentives and financing options to make the most of your electric vehicle experience!