5 steps to claim your ev incentives

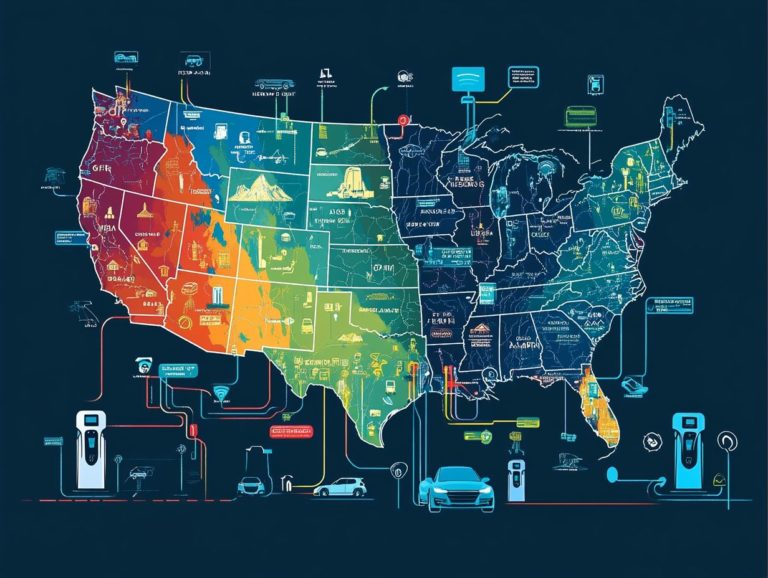

Navigating the landscape of electric vehicle (EV) incentives can indeed feel daunting, given the many options and requirements at play. Don t miss out on saving money let’s get started!

Whether you re a first-time buyer or contemplating an upgrade, grasping how to claim these incentives is crucial for maximizing your savings.

This article lays out five essential steps to successfully claim your EV incentives. It guides you from researching available options to gathering the necessary documentation. It also delves into eligibility criteria, highlights common pitfalls to sidestep, and offers tips to ensure a seamless application process.

Prepare to electrify your ride while enjoying significant savings.

Contents

Key Takeaways:

Research and understand the available EV incentives in your area before making a purchase.

Confirm your eligibility for the incentives and gather all necessary documents before submitting your application.

Follow up on your application to ensure you get your incentives on time!

1. Research Available Incentives

Researching available incentives is an essential first step if you’re considering buying an electric vehicle (EV) or plug-in hybrid. Both federal and state programs offer various tax credits, rebates, and incentives to encourage EV adoption.

By understanding the specifics of these incentives, you can unlock significant savings. For instance, the federal clean vehicle tax credit can notably reduce your tax liabilities. Many states provide additional EV rebates or grants that can lower your purchase price even further.

Keep in mind that programs can vary significantly from one state to another. Staying informed about both local and federal guidelines is crucial. Consulting resources like the U.S. Department of Energy is highly beneficial, as they offer updated information and tools to help you navigate the often complex landscape of EV incentives.

By taking these steps, you can fully capitalize on the programs available to you and contribute to the shift toward a more sustainable future.

2. Determine Eligibility

Determining your eligibility for the clean vehicle tax credit and other EV incentives is essential. This process entails understanding a range of requirements, including income limits, vehicle identification number guidelines, and rules set by the IRS.

To start, assess your income level. Both federal and state programs typically impose specific thresholds that could impact your eligibility. Next, ensure that your vehicle meets the required criteria, such as the type of electric vehicle, its purchase date, and its qualification under various incentive programs. For more information, check out this helpful guide to EV incentives in your state.

Checking the vehicle identification number (VIN) is vital to confirm whether your car qualifies for these incentives. Consulting the IRS guidelines will clarify your requirements and help you stay compliant with all necessary regulations while maximizing your potential benefits.

3. Gather Required Documents

Gathering the necessary documents is a crucial step in claiming EV incentives. You’ll need to prepare Form 8936, a tax form used to claim your EV credit, provide a time-of-sale report, and ensure you have a copy of your vehicle identification number to successfully process your application. For more details on how to apply for electric vehicle rebates, be sure to review the guidelines.

In addition to these essentials, it’s imperative to include the purchase receipts that confirm the transaction details of your electric vehicle. These receipts act as solid proof of your purchase date and price, key elements for verifying your eligibility.

You might also need to gather additional documents, such as proof of residency and any applicable tax returns from the previous year, to strengthen your application.

Filling out Form 8936 accurately is particularly important, as any discrepancies can lead to delays or rejections. Taking the time to double-check all your entries will help ensure a smoother process in securing those valuable incentives.

Ready to electrify your ride? Start your research today!

4. Submit Application

Submitting your application for EV incentives is straightforward. However, you must closely follow IRS rules to ensure your claim for the federal tax credit and any state-sponsored incentives goes smoothly. For detailed guidance on how to access EV incentives as a new buyer, be sure to consult reliable resources to avoid delays or complications.

To start, obtain and fill out Form 8936, specifically designed to determine your eligibility for the federal electric vehicle tax credit. Pay careful attention to sections requiring vehicle identification numbers and purchase dates. Even a small oversight can lead to errors.

Some states have their own unique applications, each with varying requirements and deadlines. It s wise to check with local tax authorities or consult online resources for the most accurate information.

Remember, a common pitfall is failing to maintain necessary documentation, such as purchase receipts and proof of residency. Neglecting these can result in processing delays or outright denials. A little diligence now can make all the difference!

5. Follow Up and Receive Incentives

Following up after submitting your application is crucial to ensure you receive your incentives promptly. Many applicants find that understanding the process for EV rebates tied to their electric vehicle purchase significantly enhances their experience!

Typically, expect to hear back within a few weeks, although this timeline may vary depending on the agency processing your application. If notifications are delayed, reach out to the relevant agency for updates.

Contacting them is usually straightforward just have your application details on hand to expedite the inquiry. Remember, during peak times, such as the end of the fiscal year, processing may take longer.

By understanding these timelines and knowing who to contact, you can alleviate anxiety and stay informed about your incentives.

What Are the Different Types of EV Incentives?

The landscape of EV incentives is diverse, featuring various programs that include federal tax credits, state tax incentives, and targeted rebates to promote the purchase of clean vehicles and alternative fuels. Leveraging these incentives makes the transition to electric mobility more accessible and financially appealing.

These incentives work together to reduce the overall cost of electric vehicles, encouraging you to make the switch. For example, the federal tax credit offers substantial savings, allowing you to deduct a significant amount from your tax return. Meanwhile, state-sponsored incentives may include reduced vehicle registration fees or exemptions from certain taxes.

Rebates for charging stations, known as Electric Vehicle Supply Equipment (EVSE) tax credits, help you install home charging stations, enhancing the convenience of owning an electric vehicle.

Collectively, these programs create a robust ecosystem designed to support EV adoption, ultimately leading to cleaner air and a more sustainable future.

What Are the Eligibility Requirements for EV Incentives?

Eligibility requirements for EV incentives can vary, encompassing specific criteria such as income limits, vehicle standards, and following IRS guidelines. These criteria ensure that you qualify for available tax credits and rebates.

To take advantage of these financial incentives, you need to meet certain income thresholds, which can vary based on the specific program or state. Many programs set limits reflecting the broader economic landscape, making it essential to verify your financial standing before applying.

Your vehicle must meet strict identification criteria, typically requiring it to be a newly manufactured electric or plug-in hybrid model, often within designated price ranges. Both state governments and the IRS monitor these criteria closely to filter out non-compliant claims, ensuring you can legitimately and effectively enjoy the benefits.

In summary: Familiarize yourself with the application process, follow IRS rules, and maintain documentation. Stay informed about eligibility requirements, and don t hesitate to ask for help if needed!

What Documents Are Typically Required for an EV Incentive Application?

When you are applying for EV incentives, you’ll typically need several key documents. These include Form 8936, a time-of-sale report, proof of vehicle purchase, and your vehicle identification number. To further assist you, learn how to find EV incentives in your area. These items are crucial for confirming you qualify and streamlining the application process.

Form 8936 is a tax form used to claim the federal electric vehicle tax credit. You might also need a copy of your driver’s license or state ID to verify your identity. Proof of residency ensures that the incentives are distributed according to regional policies.

Providing documentation for any local rebates can strengthen your application. This shows your comprehensive compliance with the program requirements.

Together, these documents not only serve as proof of purchase but also reinforce the integrity of the incentive program, empowering you to navigate the complexities of the process with confidence.

How Long Does It Take to Receive the Incentives?

The timeline for receiving EV incentives can vary based on several factors. These include the type of incentive you re claiming, how quickly tax returns are processed, and the regulations in your state. It s crucial to stay informed about the expected durations for federal rebates and other incentives.

For example, some states might process applications in just a few weeks, while others could take several months. This discrepancy often stems from the volume of applications or specific state policies. It s wise for you to get acquainted with local regulations and any recent changes, as these can significantly affect your timeline.

Once you ve submitted your application, make it a point to follow up with the relevant agencies or departments. Confirming receipt and inquiring about the projected processing time not only demonstrates your diligence but can also help clarify any unforeseen delays in receiving your incentives.

What Are Some Tips for Successfully Claiming EV Incentives?

Successfully claiming EV incentives requires attention to detail and proper documentation. To enhance your chances of securing the federal tax credit and other rebates, consider a few strategic tips, including understanding 5 ways EV incentives can save you money. Meticulously prepare the required forms and follow up promptly.

To maximize your chances of success, it’s essential to gather all relevant receipts, proof of purchase, and necessary tax documents before submission. Understanding the eligibility criteria for various incentives is equally crucial; this knowledge can save you time and resources.

Keeping a calendar to remind yourself to check in with the relevant authorities after submitting your application is a smart move. This way, you won t miss any critical deadlines. By maintaining organized records and fostering open communication, you can streamline the process and potentially unlock significant savings.

Avoid These Common Mistakes When Claiming EV Incentives!

Many applicants stumble into common pitfalls when seeking EV incentives, including overlooking eligibility requirements and submitting incomplete documentation. To avoid these issues, it’s important to know how to qualify for local EV rebates, as this can significantly improve the approval process for those valuable tax credits and rebates.

These mistakes not only slow down your approval but can also lead to the rejection of otherwise valid applications. It s essential for you to thoroughly review the specific eligibility criteria set forth by governing bodies, as these can vary widely depending on the state or federal program.

Ensure all required documentation, such as proof of purchase and tax identification numbers, is organized and accurately completed. A meticulous approach can save you time and spare you the frustration of having to resubmit or correct errors.

With a bit of care during your application, you can enjoy a smoother experience and secure the benefits you deserve!

Frequently Asked Questions

What are the 5 steps to claim your EV incentives?

The 5 steps to claim your EV incentives are as follows:

- Research the available incentives to know what you can claim.

- Determine your eligibility for each incentive.

- Gather all required documentation.

- Submit your application for incentives.

- Receive and utilize your incentives.

What types of incentives are available for EV owners?

EV owners can access several incentives. These include federal tax credits, state rebates, utility company rebates, and local discounts. Research these options to maximize your savings!

How do I know if I am eligible for EV incentives?

Eligibility varies by incentive and location. Factors like your income, vehicle type, and location affect your chances. Check the requirements for each incentive before applying.

What documents do I need to claim my EV incentives?

Common documents include proof of purchase or lease of an eligible EV, proof of residency, and vehicle registration. Gathering these documents is crucial, especially to understand the surprising benefits of EV financial incentives before submitting your application!

How do I submit my application for EV incentives?

The application process varies by incentive and location. Usually, you ll submit your application online through the appropriate government or utility website. Follow the instructions closely!

When will I receive my EV incentives?

The timeline for receiving incentives varies. Some incentives come immediately, while others may take weeks or even months. Check the expected timeline for each to plan ahead.