exploring financial incentives for ev fleets

Electric vehicle (EV) fleets are becoming essential for sustainable transportation. Their widespread adoption relies heavily on financial incentives.

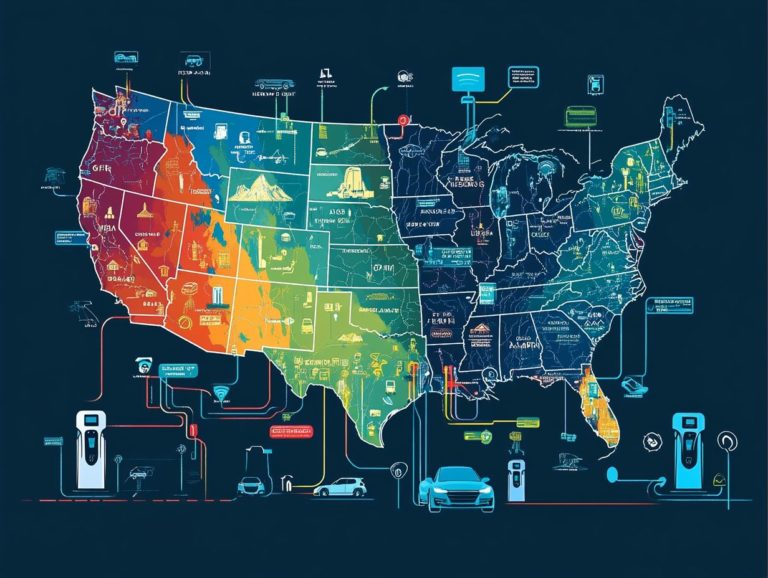

As you consider the transition to greener alternatives, understanding the various forms of incentives such as tax credits, grants, and infrastructure support becomes essential. Infrastructure support includes the development of charging stations and maintenance facilities.

This article delves into successful case studies, assesses the effectiveness of these financial programs, and uncovers the challenges they encounter.

By exploring the future outlook and providing actionable recommendations, the goal is to empower you and other stakeholders to promote EV fleets more effectively.

Jump in and discover how financial incentives are transforming the future of transportation!

Contents

- Key Takeaways:

- What are EV Fleets?

- Why are Financial Incentives Important?

- Types of Financial Incentives for EV Fleets

- Case Studies of Successful Financial Incentive Programs

- Effectiveness of Financial Incentives for EV Fleets

- Challenges and Limitations of Financial Incentives for EV Fleets

- Future Outlook and Recommendations

- Frequently Asked Questions

- What are financial incentives for EV fleets?

- Why should companies consider exploring financial incentives for EV fleets?

- What types of financial incentives are available for EV fleets?

- How can companies find out about financial incentives for EV fleets?

- Do financial incentives for EV fleets vary by location?

- Are there any eligibility requirements for financial incentives for EV fleets?

Key Takeaways:

Financial incentives are vital for adopting EV fleets. They help offset initial costs and encourage fleet operators to choose greener transportation solutions. Understanding how local incentives help EV adoption shows that tax credits, rebates, grants, and funding programs are all effective types of financial incentives that must be carefully designed and implemented to ensure success.

Despite some challenges and limitations, financial incentives have proven effective in increasing adoption rates and reducing emissions from transportation. However, they should be used alongside other strategies for promoting EV fleets.

What are EV Fleets?

EV fleets embody a transformative shift in the transportation landscape, featuring electric vehicles (EVs) tailored for commercial use.

These fleets encompass a diverse range of vehicle types, from battery electric vehicles and plug-in hybrids to clean delivery vehicles. All play a pivotal role in reducing emissions and operational costs.

As governments and organizations increasingly champion environmental sustainability, the adoption of EV fleets is gaining momentum. This is particularly true in urban centers where charging infrastructure is expanding to facilitate the transition to electrified transportation.

Why are Financial Incentives Important?

Financial incentives are pivotal in expediting the adoption of electric vehicles (EVs), especially for buyers grappling with high upfront costs.

Programs that offer tax benefits, such as the federal tax credit and various state incentives, significantly reduce the effective cost of acquiring clean vehicles. By making EVs more affordable, these incentives boost sales and advance broader objectives related to environmental sustainability and emission reductions.

Dealerships are now capitalizing on these incentives to attract customers eager to make the switch to electric vehicles.

Types of Financial Incentives for EV Fleets

Understanding the various financial incentives available for EV fleets is crucial for organizations aiming to navigate the world of EV financial incentives effectively.

These incentives come in multiple forms think tax credits, rebates, grants, and funding programs all designed to help offset the costs of purchasing electric vehicles and developing the required charging infrastructure.

For instance, the Clean Commercial Vehicle Credit supports businesses investing in electric delivery vehicles by offering substantial financial credits. Additionally, direct pay options can make these incentives even more appealing for fleet managers in search of cost-effective solutions.

Tax Credits and Rebates

Tax credits and rebates are crucial financial incentives for you as an EV buyer. They significantly reduce the effective purchase price of electric vehicles.

These incentives, including the federal tax credit and various state tax programs, motivate you to embrace environmentally friendly transportation while ensuring that your vehicle meets eligibility criteria based on its identification numbers and emissions standards.

Understanding the nuances of these financial benefits can profoundly affect your decision-making process. For example, in California, you can access an upfront rebate that may reach up to $7,000. In New York, substantial tax credits incentivize the purchase of zero-emission vehicles.

To qualify, you often need to meet specific income thresholds and ensure your selected vehicle has a qualifying battery capacity. Researching local options is essential, as they can yield significant savings and bolster your transition toward sustainable energy solutions.

Grants and Funding Opportunities

Grants and funding opportunities are vital for organizations developing electric vehicle (EV) fleets. They help build the necessary supporting infrastructure.

These financial aids, often extended by government entities or non-profits, can significantly alleviate the costs associated with acquiring electric trucks and installing public charging stations. This not only lowers running costs but also promotes fleet electrification, which means converting a fleet of vehicles to electric power.

You’ll find various programs available at both state and federal levels. Each program has its own set of eligibility criteria that can vary from fleet size requirements to local operational standards. Many organizations can leverage these grants to upgrade their vehicle inventory and invest in creating vital charging networks.

The application process can differ, typically requiring detailed project proposals. These proposals should outline your intended use of funds, expected benefits, and sustainability goals.

Tap into these funding sources to accelerate your transition to electric vehicles and enjoy long-term savings and environmental benefits.

Infrastructure Support

Infrastructure support is essential for seamlessly integrating electric vehicles into your existing fleet operations. It ensures you have adequate charging facilities at your disposal.

Initiatives to establish EV charging stations are supported by federal incentives and various funding programs. These initiatives empower you to enhance your electric vehicle capabilities, ultimately elevating the experience for EV buyers.

With a robust network of charging stations, you can maximize vehicle uptime and efficiency. This allows you to deliver reliable service to your customers while championing sustainable practices.

Government initiatives, including grants and tax credits, significantly alleviate the financial strain associated with developing this infrastructure.

By fostering collaboration among dealerships, local governments, and private enterprises, you facilitate effective planning and ensure equitable access to charging facilities.

In the end, the expansion of EV charging infrastructure supports fleet operators like you and provides everyday consumers with the convenience and reliability of a well-supported electric vehicle ecosystem.

Case Studies of Successful Financial Incentive Programs

Examining case studies of successful financial incentive programs offers valuable insights into effective strategies for promoting electric vehicle (EV) adoption across various regions.

Take states like California, New Jersey, and Illinois, for example. They have implemented robust financial incentives specifically designed for EV fleets, showcasing how strategic financing and support mechanisms can lead to notable increases in both EV sales and infrastructure development.

Examples from Various Cities and Countries

Various cities and countries are embracing innovative financial incentives for EV fleets. You can see the successful implementations and notable emissions reductions that follow. Take California’s Clean Vehicle Rebate Project and Oregon’s EV infrastructure initiatives, for example. They ve set the stage for increased adoption rates, demonstrating how effective targeted funding programs and robust policy frameworks can be.

Comparing these programs to those in European cities like Amsterdam and Stockholm reveals distinct strategic approaches. Amsterdam prioritizes charging station accessibility and green energy integration, aligning perfectly with its ambitious sustainability goals. Meanwhile, Stockholm has rolled out subsidies aimed at reducing initial purchase costs for electric vehicles.

These different strategies showcase the diversity in financial incentives while providing valuable insights into consumer behavior and urban planning. You ll find key lessons about the importance of community engagement and the necessity for adaptive policies that respond to technological advancements and user feedback. Ultimately, this enhances the overall effectiveness of these green initiatives.

Effectiveness of Financial Incentives for EV Fleets

Evaluating financial incentives for EV fleets is crucial for understanding their impact on adoption rates and emissions reduction, especially considering the future of electric vehicle financial incentives.

Research shows that well-designed financial incentives can dramatically boost EV sales. They also help reduce operational costs and support broader environmental goals.

Impact on Adoption Rates and Emissions Reduction

The impact of financial incentives on adoption rates and emissions reduction is clear in the growing electric vehicle market. Incentives like the Clean Commercial Vehicle Credit play an important role in increasing EV sales.

These incentives motivate businesses to adopt cleaner practices, leading to significant emission reductions. Studies suggest that tax credits can raise EV adoption by up to 70%, adding tens of thousands of new vehicles each year.

Case studies in California and Norway show that generous subsidies can lead to emission reductions beyond initial targets. Progressive policies speed up the transition to sustainable technologies and provide a model for other regions aiming to meet climate goals.

Challenges and Limitations of Financial Incentives for EV Fleets

While financial incentives can drive EV adoption, they present challenges that may limit their effectiveness.

Barriers include funding gaps, a lack of awareness about available incentives, and inconsistent government support. These issues can slow the growth of EV fleets and hinder environmental sustainability goals.

Potential Drawbacks and Solutions

Challenges of financial incentives for EV fleets include administrative complexities and limited coverage. To solve this, develop streamlined application processes and raise public awareness about financial programs.

Complex guidelines can deter interested participants. Establish clear criteria and deadlines, and create outreach strategies for underserved communities to ensure everyone has access.

Working with local dealerships and community organizations can enhance awareness and assist buyers with these financial programs. Implementing these solutions fosters a more inclusive environment that encourages participation in the electric vehicle transition.

Future Outlook and Recommendations

The future for financial incentive programs supporting EV fleets looks promising. Strategic recommendations will enhance their effectiveness.

As electric vehicles become more popular, it’s crucial for governments and organizations to refine existing programs. This ensures they align with infrastructure development and environmental goals, paving the way for a sustainable future.

Improving and Expanding Financial Incentive Programs

Enhancing financial incentive programs is crucial for EV growth, especially in understanding how to leverage incentives for EV charging stations, making them accessible to more people.

Collaborations between government and private companies, along with increased investment in EV infrastructure, create a supportive environment for fleet managers and EV buyers.

By aligning incentives with real-world usage and operational needs, tailored programs can actively encourage electric vehicle adoption.

For instance, integrating rewards for reducing carbon footprints or providing rebates for charging stations can significantly enhance participation rates.

Engaging local governments, private investors, and electric utilities in a collaborative effort pools resources, reducing upfront costs associated with transitioning to electric fleets.

This multifaceted approach not only boosts the financial viability of electric vehicle adoption but also propels the advancement of clean transportation technologies.

Other Strategies for Promoting EV Fleets

Beyond financial incentives, explore targeted marketing initiatives and community engagement efforts to promote EV fleets effectively.

Educating the public about the advantages of electric vehicles and their positive environmental impact can significantly boost adoption rates.

Hosting local events and workshops provides hands-on experiences that make the technology accessible and inviting for everyone.

Collaborating with schools and community organizations cultivates a culture of sustainability from an early age.

Leveraging social media allows for sharing engaging content that showcases real-life success stories, further fueling interest and acceptance.

These combined efforts are essential! It s crucial for communities to see the incredible benefits of embracing electric vehicles both for personal use and the greater good of the environment and public health.

Frequently Asked Questions

What are financial incentives for EV fleets?

Financial incentives for EV fleets are monetary rewards or benefits offered by governments or organizations to encourage the adoption of electric vehicles in fleet operations, as detailed in exploring the impact of EV incentives on consumers.

Why should companies consider exploring financial incentives for EV fleets?

Companies should explore the role of incentives in electric vehicle adoption for EV fleets because they can reduce operational costs, increase sustainability efforts, and improve brand image.

What types of financial incentives are available for EV fleets?

Various types of financial incentives are available for EV fleets, including tax credits, grants, rebates, and subsidies for purchasing or leasing EVs. Additionally, incentives for installing charging infrastructure can also play a significant role in enhancing the appeal of electric vehicle ownership.

How can companies find out about financial incentives for EV fleets?

Companies can learn about financial incentives for EV fleets by researching government websites, consulting with industry experts, or understanding incentive trends for electric vehicles through local utility companies.

Do financial incentives for EV fleets vary by location?

Yes, financial incentives for EV fleets may vary by location, as different governments and organizations offer various programs and understanding EV charging incentives based on their policies and priorities.

Are there any eligibility requirements for financial incentives for EV fleets?

Yes, eligibility requirements for financial incentives for EV fleets may include factors like the type and size of the fleet, the types of EVs purchased or leased, and the location of fleet operations.