how to find ev incentives in your area

Electric vehicles (EVs) are becoming increasingly popular, not only for their eco-friendly advantages but also because of the array of incentives available that make the transition more financially appealing.

By understanding EV incentives, you can significantly lower your overall costs. You can benefit from substantial tax credits, rebates, and discounts on charging equipment.

This article explores the various types of EV incentives and guides you on how to find them in your area. It also offers tips for maximizing these benefits.

It provides insights into the future of these programs, ensuring you stay informed and prepared.

Whether you re already an EV owner or contemplating the switch, you ll find valuable information here to help you navigate this exciting landscape.

Contents

- Key Takeaways:

- Understanding EV Incentives

- Types of EV Incentives

- How to Find EV Incentives in Your Area

- Making the Most of Your EV Incentives

- Exciting Changes Ahead for EV Incentives!

- Preguntas Frecuentes

- C mo puedo averiguar si hay incentivos para veh culos el ctricos (EV) en mi rea?

- Qu tipos de incentivos est n t picamente disponibles para veh culos el ctricos en diferentes reas?

- Existen incentivos federales para veh culos el ctricos?

- Necesito solicitar incentivos para veh culos el ctricos, o se aplican autom ticamente?

- Con qu frecuencia cambian o expiran los incentivos para veh culos el ctricos?

- Puedo combinar m ltiples incentivos para veh culos el ctricos?

Key Takeaways:

- Understand what EV incentives are and how they can benefit you as an electric vehicle owner.

- Research local and state programs to find out what incentives are available in your area.

- Maximize your EV incentives by staying informed, planning ahead, and taking advantage of all available options.

Understanding EV Incentives

Understanding state-level EV incentive programs is essential for lowering your electric vehicle (EV) costs while also making a positive impact on a sustainable future.

These incentives, offered by organizations like San Diego Gas & Electric and Alameda Municipal Power, are key to making electric vehicles more affordable and accessible.

With options ranging from rebates and tax credits to specialized programs, understanding EV charging incentives encourages the adoption of clean energy and helps reduce greenhouse gas emissions.

As demand for electric vehicles continues to rise, grasping these incentives becomes increasingly important for maximizing your savings and promoting a cleaner environment.

What are EV Incentives?

EV incentives are financial perks offered by federal, state, and local governments to inspire you to embrace electric vehicles and sustainable practices.

These incentives take various forms, such as rebates, tax credits, and grants, easing the financial burden of purchasing both new and used electric vehicles.

For example, the Federal Tax Credit provides a substantial deduction on your income taxes when you buy an electric vehicle. The amount depends on the model and its battery capacity.

Many states also offer their own rebates and incentives, like the Charging Station Rebate, which supports the installation of home charging stations. This makes it convenient for you to charge your vehicle at home.

These programs champion cleaner transportation and empower you to transition to more sustainable options with confidence.

Types of EV Incentives

You’ll find a variety of EV incentives that enhance your electric vehicle ownership experience, including how to find the best local EV deals that offer opportunities to save money while championing clean energy.

These incentives typically fall into four main categories:

- Tax credits

- Rebates

- Discounts on charging equipment

- Unique programs crafted by local utilities to promote the adoption of electric vehicles

Tax Credits and Rebates

Tax credits and rebates are among the most enticing incentives for electric vehicle (EV) buyers. They offer immediate financial relief when purchasing an electric vehicle.

These incentives can vary widely, with the Federal Tax Credit often providing substantial savings that can soar into the thousands, depending on the make and model of the vehicle you choose.

Beyond federal offerings, many states and local jurisdictions also provide their own unique tax credits and rebates, along with attractive perks such as access to carpool lanes or reduced toll fees.

To reap the benefits of these incentives, you’ll typically need to fill out specific application forms either through your tax returns or your state s department of motor vehicles. By leveraging these programs, you can significantly reduce your overall purchase costs, making the transition to electric vehicles not just feasible but truly appealing.

Discounts on Charging Equipment

Discounts on charging equipment are helpful discounts that help lower the initial costs of setting up electric vehicle charging stations, whether at home or in public areas.

Financial aids such as the Charging Station Rebate and Residential EV Charger programs can significantly ease the costs for those eager to embrace electric mobility.

The benefits of using smart charging apps go beyond mere savings; they provide features that optimize energy consumption and allow you to monitor usage patterns effortlessly.

Local governments offer various grants to incentivize electric vehicle usage, creating a robust environment for sustainable energy solutions.

By seizing these opportunities, both individuals and businesses can enhance their charging infrastructures while actively supporting the transition to greener transportation options.

Special Parking and Toll Benefits

Special parking and toll benefits serve as enticing incentives to encourage your electric vehicle use, enhancing convenience and efficiency for you as a driver.

These perks simplify your daily commute and make driving more enjoyable, allowing you to spend less time stuck in traffic.

Access to High Occupancy Vehicle (HOV) lanes enables you to glide through congested areas with ease, while toll discounts can translate into substantial savings over time.

Recognizing the importance of promoting clean energy, many local utilities extend various incentives to electric vehicle users.

You might find rebates on charging equipment or reduced electricity rates during off-peak hours. Together, these advantages render the idea of owning an electric vehicle appealing and financially astute for many drivers like yourself.

How to Find EV Incentives in Your Area

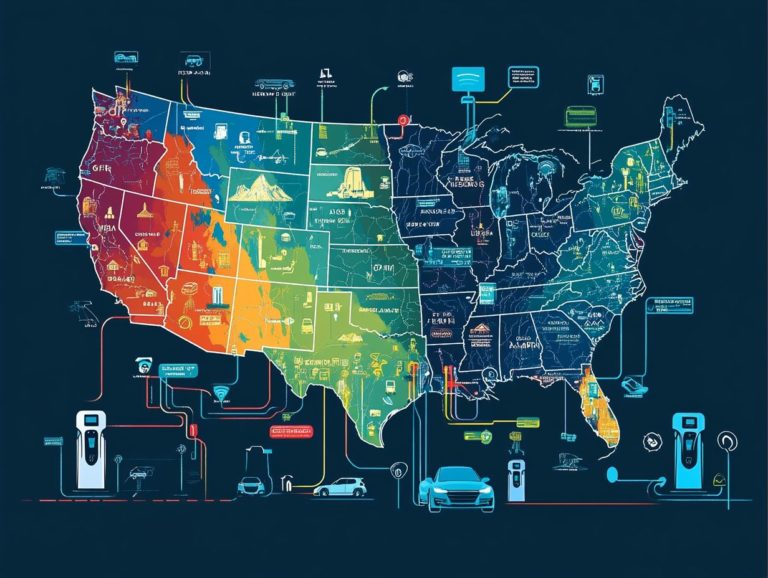

Discovering the best EV incentives in 2024 in your area requires a strategic approach, combining thorough research with the wealth of online resources at your disposal.

By harnessing tools such as the Electric Vehicle Savings Finder and exploring platforms like Access Clean California, you can effortlessly navigate local and state programs.

This gives you the power to pinpoint the financial incentives that align perfectly with your needs, making your journey toward sustainable driving both rewarding and economical.

Researching Local and State Programs

Researching local and state programs is crucial for maximizing the benefits of EV financial incentives, as the availability and types of incentives can vary significantly depending on your location.

To kick off this process, you should first explore the official websites of your local public utilities departments. These sites often provide comprehensive resources detailing the various programs available.

For example, many utilities might offer enticing rebates on electric vehicle chargers or reduced rates for charging during off-peak hours.

It s also a smart move to contact representatives directly through their customer service lines or designated energy consultants. They can offer tailored advice and address any specific queries you might have.

Additionally, state energy offices typically maintain listings of incentive programs, such as how to qualify for local EV rebates, making it easier for you to uncover hidden opportunities that can significantly enhance the overall value of owning an electric vehicle.

Using Online Tools and Resources

Utilizing online tools and resources is a savvy approach to access information about state-specific EV rebates, giving you the power to make well-informed decisions.

By tapping into platforms like the Electric Vehicle Savings Finder, you can effortlessly uncover relevant incentives and learn how to stay updated on EV incentives tailored specifically to your needs.

These interactive tools allow you to compare various incentives side by side, offering valuable insights into potential savings over time.

Features like ratings and reviews enable you to assess the performance and reliability of different electric vehicle models, making the decision-making process much smoother.

Ultimately, these online resources can significantly streamline your journey in finding applicable incentives, ensuring that you maximize your benefits while navigating the ever-evolving landscape of electric vehicles.

Start exploring these incentives today and save money while going green!

Making the Most of Your EV Incentives

Making the most of your EV incentives requires a proactive mindset. Understanding and leveraging available programs effectively is essential.

By adopting strategic tips and using tools like the Smart Charging App, you can elevate your electric vehicle savings. This approach allows you to fully capitalize on incentives such as the Charging Station Rebate and off-peak charging options, ensuring maximum benefits.

Tips for Taking Advantage of Incentives

Taking full advantage of incentive programs can significantly lower the costs of owning an electric vehicle. Strategic planning is key.

To ensure you re getting the most benefits, stay informed about local, state, and federal incentives. Researching eligibility criteria is crucial, as many programs have specific requirements.

As a prospective owner, apply for rebates and tax credits promptly to avoid missing out on limited-time offers. When considering which incentives to use, evaluate the long-term savings against immediate benefits, as some incentives may provide more value depending on your driving habits and charging options.

Exciting Changes Ahead for EV Incentives!

Expect significant expansions in programs focused on promoting clean energy and increasing electric vehicle adoption.

As public awareness grows and technology evolves, you are likely to see transformations in incentive structures that make owning an electric vehicle even more appealing.

Predictions and Changes in Incentive Programs

Predictions suggest a shift toward more streamlined processes and greater access to funds supporting clean energy initiatives.

With new technologies and changing consumer preferences, these programs may become easier to access and navigate. Imagine mobile applications and online platforms that simplify the application process, making it effortless for you and your business to tap into available incentives.

As you and others grow more eco-conscious, incentive programs may be designed specifically to promote electric vehicle adoption. This could mean attractive rebates or tax credits that significantly reduce your initial costs.

Such future offerings promise not only to enhance your economic savings but also to contribute to sustainability and environmental preservation.

Preguntas Frecuentes

C mo puedo averiguar si hay incentivos para veh culos el ctricos (EV) en mi rea?

Start by checking your local or state government website for EV incentives. Additionally, explore the best online resources for EV incentives and contact your local utility company for potential programs.

Qu tipos de incentivos est n t picamente disponibles para veh culos el ctricos en diferentes reas?

The types of incentives available for electric vehicles vary by location. Common examples include tax credits, rebates, discounts on charging equipment, and access to HOV lanes.

Existen incentivos federales para veh culos el ctricos?

S , hay incentivos federales para comprar o arrendar un veh culo el ctrico. El gobierno federal ofrece un cr dito fiscal de hasta $7,500 para veh culos el ctricos calificados.

Este incentivo puede cambiar o expirar para ciertos modelos cuando un fabricante alcance un n mero espec fico de ventas. Consulta el sitio web del IRS para obtener informaci n actualizada sobre estos incentivos.

Necesito solicitar incentivos para veh culos el ctricos, o se aplican autom ticamente?

Generalmente, necesitar s solicitar los incentivos. Cada programa tiene distintos procesos de solicitud, as que es esencial leer los requisitos de elegibilidad detenidamente.

Algunos incentivos requieren prueba de compra o arrendamiento, as que guarda todos los documentos relevantes.

Con qu frecuencia cambian o expiran los incentivos para veh culos el ctricos?

Los incentivos pueden cambiar o expirar a menudo, as que mantente informado. Los incentivos federales dependen de las pol ticas actuales, mientras que los estatales y locales pueden variar seg n los presupuestos.

Consulta sitios web oficiales o suscr bete a actualizaciones por correo de organizaciones como Plug In America para no perderte ning n cambio.

Puedo combinar m ltiples incentivos para veh culos el ctricos?

S , puedes combinar varios incentivos, pero depende de las reglas de cada programa. Por ejemplo, podr as usar un reembolso estatal junto a un cr dito fiscal federal.

Verifica con cada programa para asegurarte de que seas elegible. A veces, tendr s que elegir entre incentivos, as que investiga bien antes de decidir.